In today’s fast-paced digital era, customer satisfaction is a key differentiator for banks. To stay competitive and deliver exceptional experiences, banks need to optimize their customer service operations. This is where ServiceNow’s Customer Service Management (CSM) module steps in, revolutionizing the way banks engage with their customers. In this blog post, we will explore how ServiceNow’s CSM can enhance efficiency in the banking industry, empowering banks to provide top-notch service and drive customer loyalty.

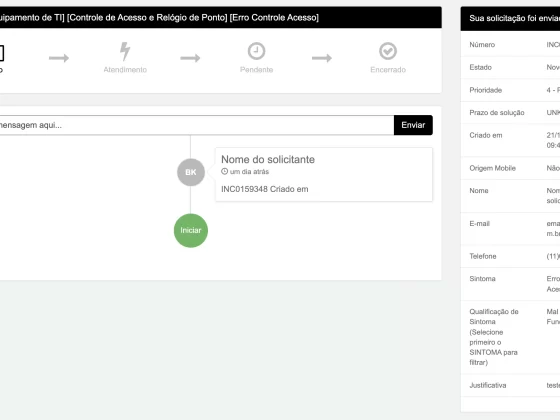

Streamlined Case Management:

With ServiceNow’s CSM, banks can effectively manage customer cases and inquiries from a single, unified platform. The module enables seamless collaboration among different teams, ensuring that customer issues are resolved swiftly and accurately. Through automated case routing and intelligent workflows, banks can optimize their response times, minimize errors, and deliver consistent support across channels.

Personalized Customer Experiences:

ServiceNow’s CSM empowers banks to personalize customer interactions by leveraging rich customer data and contextual information. Armed with a comprehensive view of each customer’s profile, history, and preferences, bank representatives can provide tailored recommendations, proactive support, and personalized offers. This level of personalization not only enhances customer satisfaction but also drives cross-selling and upselling opportunities for the bank.

Self-Service Capabilities:

In the era of digital banking, self-service options are crucial for customer convenience and efficiency. ServiceNow’s CSM enables banks to offer intuitive self-service portals, empowering customers to find answers, request services, and track their inquiries independently. By reducing the need for manual intervention, banks can free up their customer service resources to focus on more complex and high-value interactions.

Proactive Service Management:

The CSM module equips banks with powerful analytics and automation capabilities to identify and resolve potential issues before they impact customers. Through proactive monitoring and automated alerts, banks can detect patterns, predict customer needs, and take preventive actions. This proactive approach not only prevents service disruptions but also enhances customer trust and loyalty.

Omnichannel Engagement:

Modern customers expect seamless and consistent experiences across multiple channels. ServiceNow’s CSM enables banks to offer omnichannel support, ensuring that customers can reach out for assistance via their preferred communication channels such as web, mobile, chat, email, or social media. This cohesive approach enhances convenience, strengthens relationships, and boosts customer satisfaction.

ServiceNow’s CSM module is a game-changer for the banking industry, revolutionizing how banks engage with their customers. By streamlining case management, personalizing experiences, offering self-service capabilities, enabling proactive service management, and facilitating omnichannel engagement, banks can achieve new levels of efficiency and customer satisfaction. Embracing ServiceNow’s CSM empowers banks to exceed customer expectations, foster long-term relationships, and drive growth in today’s competitive banking landscape.

You must belogged in to post a comment.